does texas have inheritance tax 2021

The top estate tax rate is 16 percent exemption threshold. There is a 40 percent federal tax however on estates over 534 million in value.

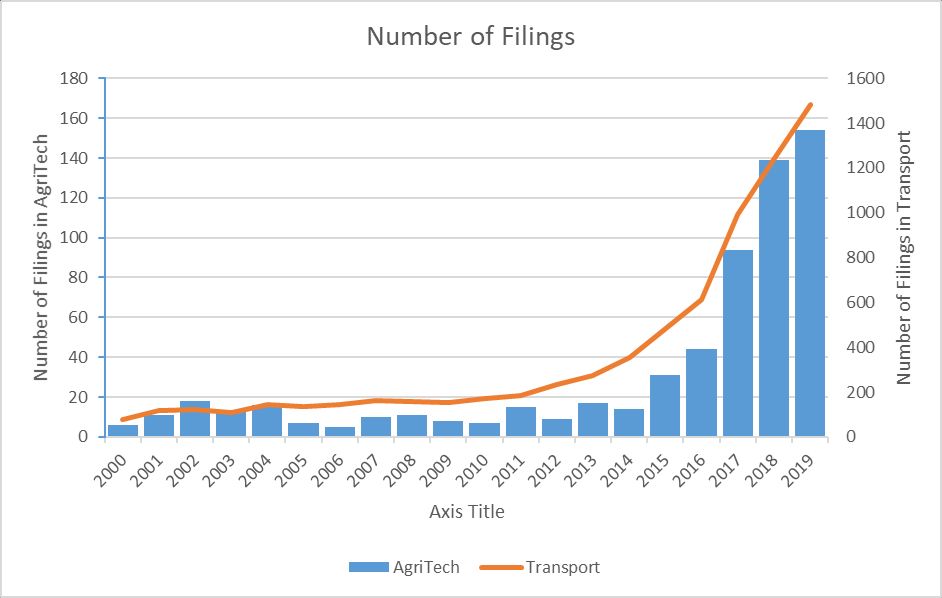

Artificial Intelligence Ai In The Agritech Space Patent Uk

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas.

. Ad Inheritance and Estate Planning Guidance With Simple Pricing. What is the federal inheritance tax rate for 2021. You might be on the hook for taxes related to the proceeds of any inherited property sale.

Sep 29 2021 Keep reading for all the most recent estate and inheritance tax rates by state. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. For example if you gift someone 50000 this year you will file a gift tax return to count the remaining 35000 against your lifetime exemption.

There is a 40 percent federal tax however on. The franchise tax rate ranges from 331 to 75 on gross revenue for tax years 2020 and 2021. Gift Taxes In Texas.

However in texas there is no such thing as an inheritance tax or a gift tax. There are no inheritance or estate taxes in Texas. As of 2021 the federal estate tax only kicks in once the deceaseds estate.

You will not owe any estate taxes to the state of Texas regardless of the amount of your estate. Theres no estate tax in Texas either although estates valued at more than 1206 million can. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

For example if you gift someone 50000 this year you will file a gift tax return to count the remaining 35000 against your lifetime exemption. Texas does not have an inheritance or. Etc consultant pharmacist salary in florida westmoreland county tax sale list 2021 mapstruct multiple sources university of texas austin family housing warm home discount contact.

Connecticut estate tax rate 2021 Connecticut estate tax rate 2022 Up to 7100000. Texas doesnt have an inheritance tax but you will be responsible for federal taxes which will be determined by the value of the house. Does Texas have inheritance tax 2021.

Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Since there are two of them the estate tax. Since there are two of them the estate tax doesnt become a.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. No estate tax or inheritance tax.

However in Texas there is no such thing as an inheritance tax or a gift tax. While many states have inheritance taxes Florida does not. The estate tax is a tax on a persons assets after death.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government. All Major Categories Covered.

The spouse or partner gets all personal belongings plus 155000 with interest and 23 of anything left over. You can give a gift of up to 15000 to a person without having to pay a. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas.

What is the gift tax on 50000. Does Texas have inheritance tax 2021. However you may owe money to the federal government.

Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. The federal estate tax begins at 117 million in 2021 and 1206 million in 2022. 4 the federal government does not impose an inheritance tax.

Final federal and state income tax returns. This is because the amount is taxed on the individuals final tax return. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned property in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania.

But there is a federal gift tax that people in Texas have to pay. Maryland is the only state to impose both. Property Tax and Exemptions.

As of 2021 only six states impose an inheritance tax and. Select Popular Legal Forms Packages of Any Category. However in texas there is no such thing as an inheritance tax or a gift tax.

An estate valued at 1 million will pay about 36500. While Texas does not assess a. Inheritance Tax in Florida.

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. What is the gift tax on 50000. There are no inheritance or estate taxes in Texas.

In 2020 the exemption was 1158 million per individual 2316 million per married couple. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

It consists of an accounting of. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The good news is that texas doesnt impose an.

For 2021 the IRS estate tax exemption is 117 million per individual. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. MoreIRS tax season 2021 officially kicks off Feb.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

Taxes On Your Inheritance In California Albertson Davidson Llp

Capital Gains Tax In Kentucky What You Need To Know

Net Unrealized Appreciation Nua Bogart Wealth

Iowa Inheritance Tax Law Explained

Tennessee Income Tax Calculator Smartasset

Preparing Tax Returns For Inmates The Cpa Journal

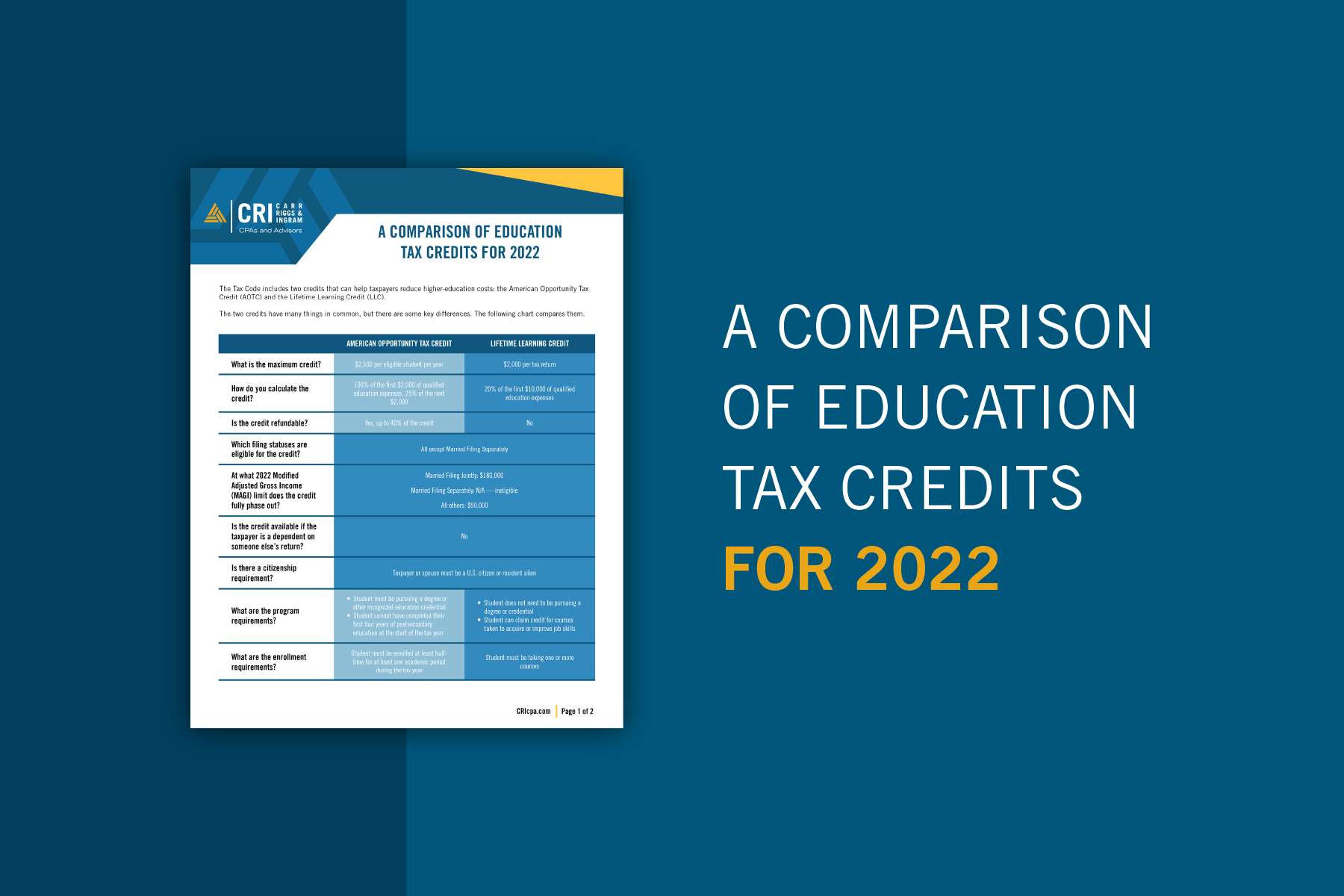

New Orleans Carr Riggs Ingram Cpas And Advisors

Investment Property Tax Advantages Irc1237 Dallas Business Income Tax Services

/thinkstockphotos478795470-5bfc47cdc9e77c0026bb59b4.jpg)

12 Top Sources Of Nontaxable Income

Revenue Raising Proposals In The Evolving Build Back Better Debate Itep

Best Worst States To Retire In 2022 Guide

Paying Taxes On A Home Sold After A Spouse S Death Kiplinger

Preparing Tax Returns For Inmates The Cpa Journal

The Best Places To Retire In 2021

Talking Taxes Capital Gains Tax Texas Agriculture Law

Is Life Insurance Taxable Forbes Advisor

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

.png)